The Beneficial Ownership Information report (BOIR) is a vital tool demanded from the Financial Crimes Enforcement Network (FinCEN) to provide clarity on the complexities of business ownership within the complex world that is financial regulation. The need for transparency and compliance with regulations becomes more crucial as companies navigate across the landscape of regulation. It is essential for them to be aware and meet their commitments. Furthermore, collaborating with a reliable service provider such as Koshika LLC helps guarantee compliance and speed up the process.

Who Needs to Turn in a BOIR?

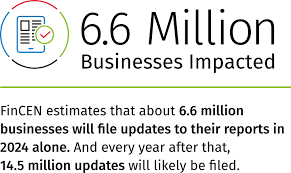

Beginning on January 1st, 2024, businesses that are situated, run, or operate within the United States are required to comply. Limited liability companies (LLCs), partnerships, corporations, and other legal entities are all covered by this. However, some exceptions should be reviewed carefully in the FinCEN website. We can help you if you require a BOIR filing.

What information is encapsulated?

In essence, an BOIR is a collection of vital information regarding the company and its owners. The most important are:

* Information about the firm The basis for ensuring compliance with regulations is established on the foundation of fundamental information, such as the name of the company, its formation day, date of registration and, if appropriate the FinCEN identification number.

Beneficial Owner Information: Comprehensive personal information regarding beneficial owners, including their legal names in full date of birth, birth dates, current addresses, as well as valid identification numbers, provide an essential background for understanding the legal and financial arrangements for business ownership.

* Application Information (After January 1st 2024) The most important part in an BOIR filing is additional details of the applicant for businesses that were that have been registered or incorporated prior to the date specified.

The consequences of failing to meet those BOIR filing requirements.

The consequences of not complying by BOIR filing requirements can be severe and can include:

*Civil Penalties: FinCEN is able to penalize companies that are not in compliance with the law a substantial amount, which highlights the importance to adhere to rules.

• Criminal penalties: Willful non-observance of BOIR regulations could be a cause for criminal charges which could negatively impact the legal standing of the offender.

* Operational Limitations: Financial institutions must be cautious when they do business with companies that don’t conform to BOIR. companies that are not compliant could face operational obstacles.

The company that is accelerating the BOIR file Koshika LLC

It shouldn’t be a hassle to adhere. Koshika LLC is ready to aid businesses in efficient and cost-effectively meeting their obligations. Koshika LLC offers impeccable BOIR filing solutions that can be customized to meet the individual requirements of each client, because of an expert team of experts who are familiar with the regulations and rules of the regulatory authorities. You can count upon Koshika LLC to expedite your compliance procedure, from meticulous data gathering to timely submission.

The Beneficial Ownership Report (BOIR) is a symbol of transparency to corporate management. Adhering to BOIR standards of compliance ensures compliance with regulations and builds confidence and trust among companies. When you have Koshika LLC on your side dealing with compliance issues can be less complicated and expensive, allowing companies to flourish in the ever-changing regulatory environment.

“Disclaimer: This article is for informational purposes only and does not constitute legal advice. Entities subject to BOIR requirements are encouraged to seek professional guidance to ensure compliance with regulatory obligations.“fessional guidance to ensure compliance with regulatory obligations.“