In the intricate tapestry of financial compliance, the Beneficial Ownership Information Report (BOIR) emerges as a pivotal tool mandated by the Financial Crimes Enforcement Network (FinCEN) to illuminate the shadows of corporate ownership. As businesses navigate the regulatory landscape, understanding and fulfilling obligations becomes paramount to maintaining transparency and regulatory adherence. Moreover, partnering with a reliable service provider like Koshika LLC can streamline the process and ensure compliance.

Who Needs to File a BOIR?

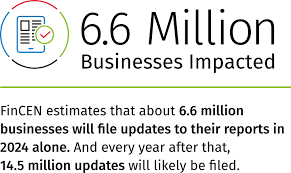

Effective since January 1, 2024, businesses operating or formed within the United States find themselves under the lens of compliance requirements. Corporations, limited liability companies (LLCs), partnerships, and various legal entities fall within the ambit of this mandate, albeit with exceptions that warrant diligent scrutiny via the FinCEN website. If you are looking for BOIR filing then contact us for assistance.

What Information is Encapsulated?

At its core, a BOIR encapsulates a mosaic of critical details concerning the company and its beneficial owners. These include:

- Company Information: Foundational details such as the company’s name, formation date, state of registration, and FinCEN identifier (if applicable) lay the groundwork for regulatory compliance.

- Beneficial Owner Information: Comprehensive personal data of beneficial owners, including full legal names, dates of birth, current addresses, and valid identification numbers, furnish vital insights into corporate ownership structures.

- Applicant Information (Post January 1, 2024): For entities established or registered post the specified date, additional applicant information forms an integral part of the BOIR submission.

Consequences of Non-Compliance with BOIR Filing Requirements

The repercussions of non-compliance with BOIR filing obligations are multifaceted and can encompass:

- Civil Penalties: FinCEN wields the authority to impose substantial fines on non-compliant entities, underscoring the imperative of regulatory adherence.

- Criminal Penalties: Wilful disregard for BOIR obligations may escalate into criminal offenses, inviting legal ramifications for errant entities.

- Operational Impediments: Non-compliant entities may encounter operational hurdles, with financial institutions exercising caution in engaging with businesses lacking BOIR compliance.

Streamlining BOIR Filing with Koshika LLC

Navigating the nuances of compliance need not be a daunting task. Koshika LLC stands ready to assist businesses in fulfilling their obligations efficiently and affordably. With a dedicated team of experts well-versed in regulatory requirements, Koshika LLC offers seamless BOIR filing services tailored to meet the unique needs of each client. From comprehensive data collection to timely submission, trust Koshika LLC to simplify your compliance journey.

In conclusion, the Beneficial Ownership Information Report (BOIR) serves as a beacon of transparency in the realm of corporate governance. Compliance with BOIR filing requirements not only fosters regulatory adherence but also reinforces trust and integrity within the business ecosystem. With Koshika LLC by your side, navigating compliance obligations becomes a streamlined and cost-effective endeavor, empowering businesses to thrive in today’s complex regulatory landscape.

“Disclaimer: This article is for informational purposes only and does not constitute legal advice. Entities subject to BOIR requirements are encouraged to seek professional guidance to ensure compliance with regulatory obligations.“